Till now, we have learned about e-commerce, its history, and “how an e-commerce seller can get their products placed at Fulfillment Centers.“

Now, in this blog, we will be going to know the process of getting a VPOB & GSTIN of the state in which the FCs are located and will also understand this via example.

Table of Contents

Process of Getting a VPOB via InstaSpaces (Official partner of Amazon & Flipkart)

Before proceeding with the process, you must understand VPOB. If you haven’t read our BLOG 2, it is recommended that you do so first, as it will help you understand the concept.

Step 1: The e-commerce sellers or business owners fill out the form on our website “https://www.goinstaspaces.com/” and choose the Virtual Office for VPOB address within 28 States and 7 Union Territories. After getting a VPOB address, you will be eligible to apply for GSTIN within that state or UT (Union Territory).,

Step 2: After filling out the form, within the next 24 hours, our consultants will give you a call or send you an email regarding your query. During the call, our consultants will guide you about the locations of VPOB according to your requirements.

Step 3: After the call, you (the e-commerce seller or business owner) will receive a quotation that includes all the details regarding the VPOB you’ve chosen.

Step 4: After the confirmation of the chosen location, the client (e-commerce/business owner) confirms the payment.

Step 5: After completion of the payment process, KYC (Know Your Customer) is initiated.

Step 6: After the KYC is done, verification & draft documents are shared with you.

Step 7: Once the documents get verified, the client can apply for GST Registration within that state.

Note: If the client wants to get GST registration done via us with our Virtual Office address, then we get them a CA assigned who will be responsible for getting the GSTIN of that state.

After following all these steps, one becomes eligible to get their inventory placed in the Fulfillment Centers of Amazon, Flipkart, Myntra, Meesho, etc.

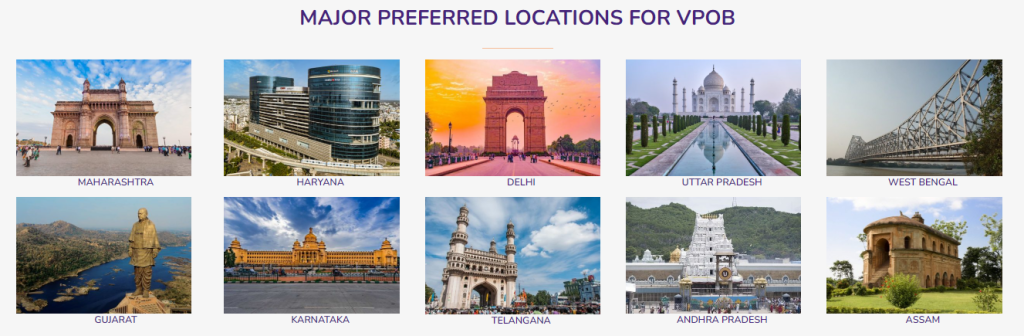

Major preferred locations for VPOB

Here is the list of the most preferred locations for getting VPOB for e-commerce. Fulfillment centers are mostly located in tier 1 cities or on the outskirts of the famous hubs. So, it’s become important for e-commerce sellers to get a “virtual principal place of business” in that state.

List of some star locations of Fulfillment Centers & FBAs of E-commerce platforms:

- Maharashtra – Pune | Thane

- Delhi

- Haryana – Gurugram

- Uttar Pradesh – Lucknow

- West Bengal – Howrah | Kolkata

- Gujarat – Ahmedabad

- Karnataka – Bangalore

- Telangana – Hyderabad

- Andhra Pradesh – Vijayawada

- Assam – Kamrup | Guwahati

How a Virtual Office Helps in Obtaining VPOB and State-wise GSTIN

A virtual office plays a crucial role in obtaining a VPOB (Principal Place of Business) and state-wise GSTIN for e-commerce sellers and businesses expanding across India. It provides a legally compliant business address in the desired state without the need for a physical office setup. This address can be used to register for GST, fulfill marketplace requirements (like Amazon, Flipkart, Blinkit), and receive official government correspondence. Virtual office providers like Instaspaces also offer essential documents—such as NOC, rent agreement, and utility bill—which are required for successful GST registration. This makes it an affordable, efficient, and compliant solution for businesses targeting multiple states.

Conclusion

If you, as an e-commerce seller or business owner, want to place your inventory in the FCs and FBAs of other states, then this is your guide, and by following the above steps, your products can get placed into the hubs.

Phone:- +91–888-270-2020

Email:- [email protected]

Happy Office Hunting

0 109

Leave a Reply